- Americans bought 26.4% more electric vehicles (EVs) in July than in June

- A $7,500 federal EV tax credit disappears soon, which has some buyers in a hurry

Electric vehicle (EV) sales spiked 26.4% last month as consumers rushed to buy cars before the federal government’s $7,500 EV tax credit expires this fall.

Used EV sales jumped 23.2% during the month. A similar $4,000 credit for used EVs will also disappear at the end of September. The latest data come from Kelley Blue Book parent Cox Automotive.

Related: EV Sales Dipped in Q2, Likely to Soar in Q3

Dealers have had an ample supply of EVs on sales lots for much of 2025. It’s dwindling as sales accelerate, and likely as dealers order fewer new EVs to sell, anticipating a sales drop when the tax credits end.

Dealers ended July with an 87-day supply of new EVs and a 40-day supply of used models. Those aren’t far off the numbers for cars of all fuel types. They ended the month with a 73-day supply of new cars and a 43-day supply of used cars.

The average transaction price for a new EV fell to $55,689 in July, down 2.2% from June and 4.2% from last July. The price drop came from increased dealer and automaker incentives. Discounts made up 17.5% of the average sale, a record in the modern EV era.

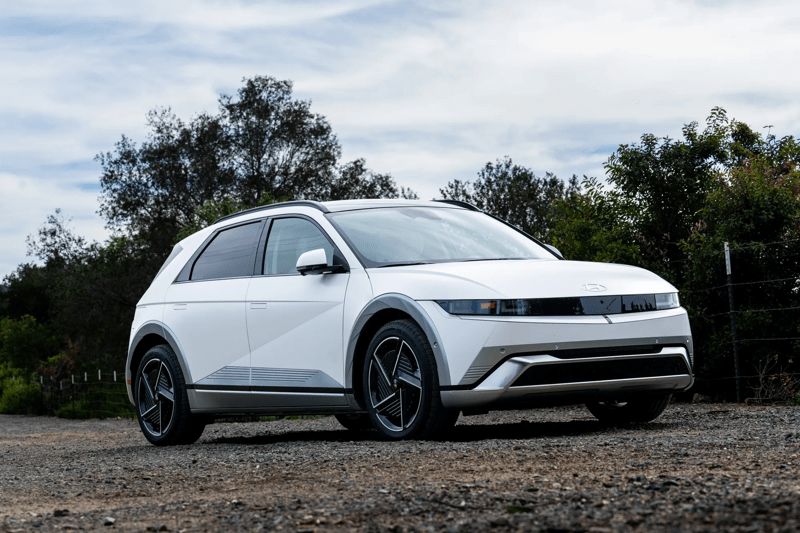

The top five selling EVs – Tesla Model Y, Tesla Model 3, Chevrolet Equinox EV, Honda Prologue, and Hyundai Ioniq 5 – all sold for an average price below $40,000. Most got there through heavy discounts, ranging from 14.5% to 27.7% of the sale price. However, the Equinox EV had no reported incentives – its low sticker price meant the average buyer paid $38,477 without a markdown.