- Electric vehicles (EVs) made up 10.5% of all new cars sold in America in the third quarter of 2025 but just 5.8% in the fourth.

- The withdrawal of a $7,500 federal EV tax credit shook the market, but will likely slow, not stop, EV sales growth.

Last year was a roller coaster for electric vehicle sales. In the end, EVs made up 7.8% of the new cars Americans bought in 2025, nearly matching the 8.1% of 2024. But they crested 10% of the market in the third quarter before falling to just 5.8% in the fourth, according to Kelley Blue Book estimates.

Outside the U.S., the International Energy Agency estimates that EVs reached 25% of worldwide auto sales in 2025.

Adoption has been much slower domestically, where EV infrastructure is a patchwork slowly filling in, and political resistance is strong. Congress and the president ended a $7,500 EV tax credit and programs aimed at developing domestic EV supply chains in September.

That created a rush of buyers in the third quarter, seeking to use the credit while they still could. It also drained buyers from the fourth quarter.

Tesla Remains the Leader, but Its Sales are Declining

- Nearly half of all EVs sold in the U.S. are Tesla products, but the company saw a second year of sales declines.

- GM benefited, with its EV sales jumping by 48% year-over-year.

Half the EV market in the U.S. is Tesla, with the other half shared by nearly three dozen brands. But Tesla controlled 75% of the market four years ago. In 2025, it saw its sales drop 7% amid increasing competition and political controversy.

GM sold just 169,887, well behind Tesla’s 589,160. Still, that’s a 48% jump from 2024.

The 10 Best-Selling EVs of 2025

| Rank | Model | 2025 Sales |

| 1 | Tesla Model Y | 357,528 |

| 2 | Tesla Model 3 | 189,903 |

| 3 | Chevrolet Equinox EV | 57,945 |

| 4 | Ford Mustang Mach-E | 51,620 |

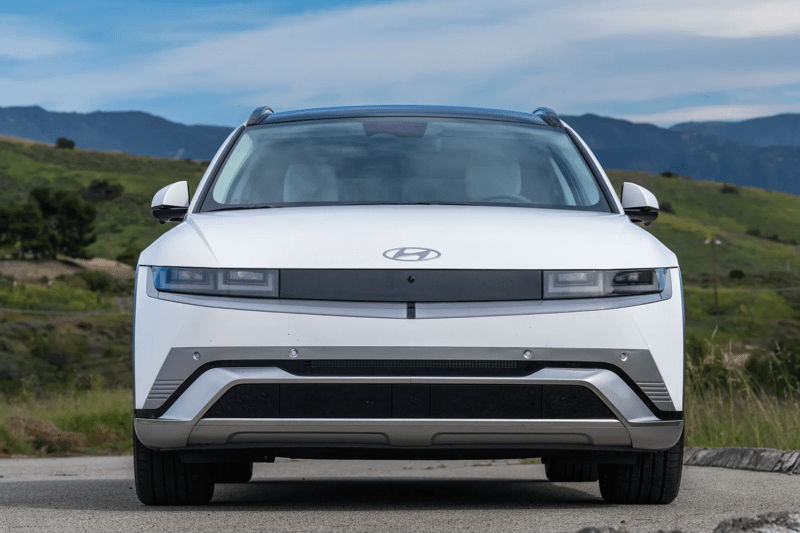

| 5 | Hyundai Ioniq 5 | 47,039 |

| 6 | Honda Prologue | 39,194 |

| 7 | Ford F-150 Lightning | 27,307 |

| 8 | Rivian R1S | 24,852 |

| 9 | Chevrolet Blazer EV | 22,637 |

| 10 | Volkswagen ID.4 | 22,373 |

What to Expect in 2026

- Cox Automotive estimates that EV sales will remain fairly flat in 2026.

- Price, range, and charging infrastructure remain the limits, and all three are improving.

“2025 unfolded largely as anticipated, with changes to federal EV incentives reshaping the demand patterns that drove record Q3 sales,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive. Cox Automotive owns Kelley Blue Book.

“Rather than signaling a retreat from electrification, this shift marks a structural transition toward a market increasingly driven by consumer choice. While 2026 will bring challenges, momentum remains grounded in market maturation: expanding model availability across price points, improving charging reliability, and continued advances in battery performance and cost.”

Cox Automotive estimates that EVs will make up 8% of all new car sales in 2026. “The U.S. market will become more electrified in the coming decade, with product innovation and infrastructure improvements supporting gradual sales growth. The automotive market in the U.S. is more than 100 years old. Change takes time,” company analysts write.