Both new and used cars grew more expensive last month, but a key indicator of future used car prices suggests that those, at least, could fall in mid-summer.

Dealers paid less for used cars at auction in the first two weeks of May than they did in April. Since dealers use car auctions to restock their used car lots, trends in the auction market usually predict the prices you and I will pay in six to eight weeks.

Tariff-Related Sales Rush Calming

New car tariffs caused inflation for car shoppers last month. The price of the average new car rose 2.5%, an unusually high increase for one month. Used car buyers paid $367 more, on average, in April than in March.

Related: Is Now the Time to Buy, Sell, or Trade-In a Car?

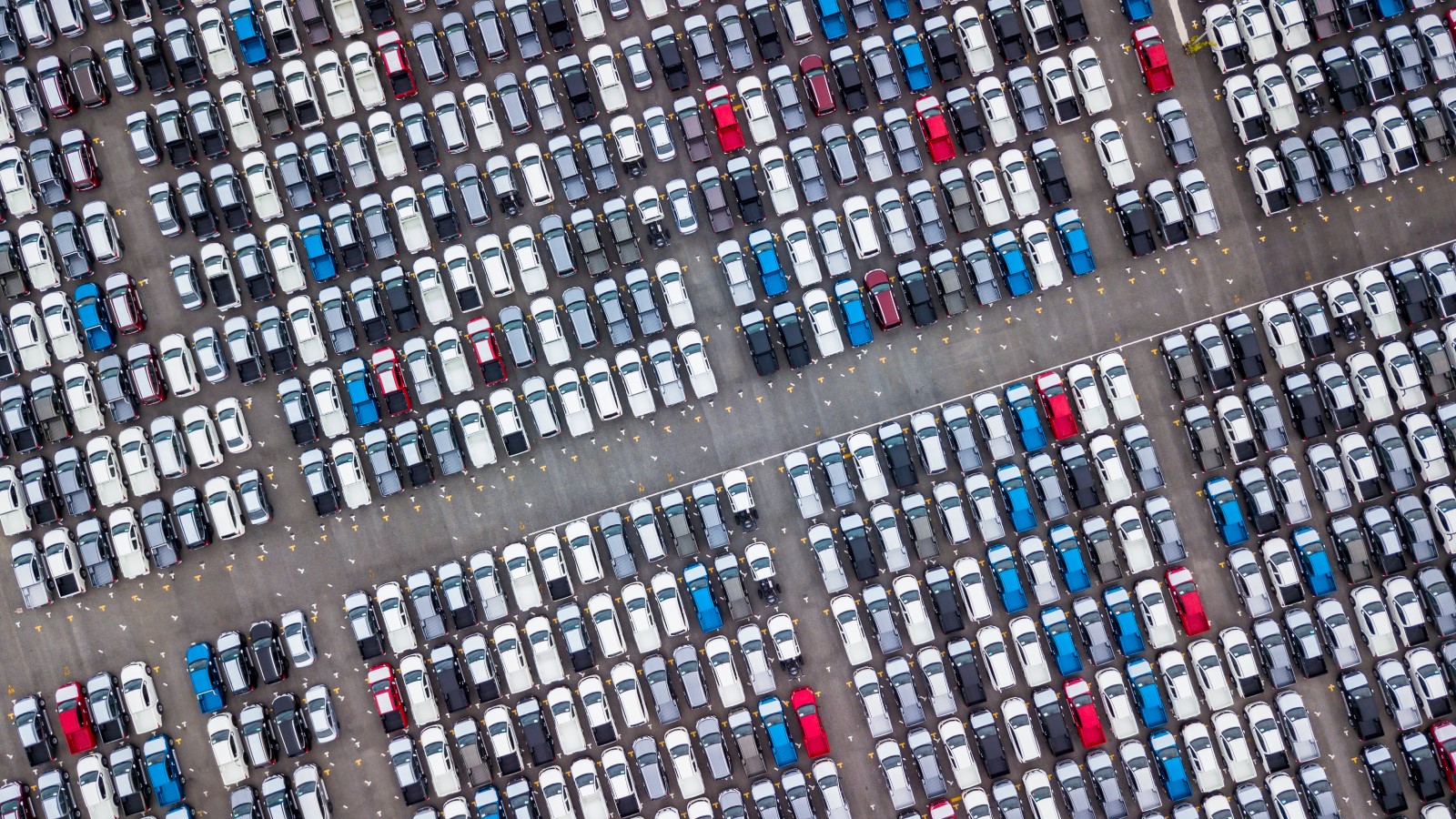

News that tariffs were coming triggered a sales rush in March, leaving dealers with thin inventory. In April, that sales rush slowed, and inventories started to recover.

The Manheim Used Vehicle Value Index tracks the prices dealers pay at auction for used cars they will later sell to consumers. It’s now 4.4% higher than it was a year ago, but falling. Kelley Blue Book parent company Cox Automotive publishes the index.

“As the tariff situation evolves and the frenzy of buying activity for new vehicles calms down, we expect wholesale pricing trends to remain more normal through Q2,” says Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive.

Some Bargains Available

Dealers paid less for every type of vehicle in the first two weeks of May than in April. But some segments declined more than others.

Truck prices dropped 1.7% at auction. Compact car prices at auction have continued to decline even as other market segments have seen big increases. Dealers paid 1.9% less for those in early May. SUV prices fell by 1%. Midsize car prices fell the least, declining by just half a percent.