- Families with household incomes of $150,000 or more bought 43% of new cars last year, up from 33% in 2019.

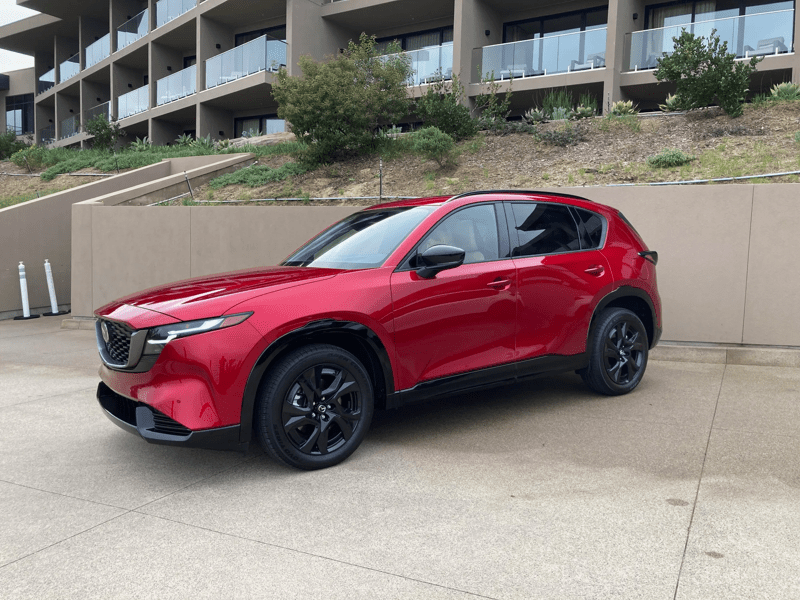

- Automakers have responded by designing more high-priced models and cutting inexpensive cars from their lineups.

New cars are increasingly a luxury purchase.

Using data from Kelley Blue Book parent company Cox Automotive, The New York Times reports, “Families with a household income of $150,000 a year or more now buy 43% of the new cars sold in the country, up from one-third of all cars sold in 2019 before the Covid-19 pandemic.”

At the other end of the scale, families with household incomes under $75,000 “are buying about a quarter of vehicles sold, down from more than a third in 2019.”

Automakers have tailored their lineups in response, designing more high-end models and trimming less expensive cars from their lineups.

In 2017, they built 61 models priced at $60,000 or more. This year, they build 114.

In 2017, they built 36 models priced at $25,000 or under. Today? Four. Just last week, Nissan canceled the last car with a sub-$20,000 price tag.

The industry-wide move upscale leaves a gaping hole at the bottom of the market, but automakers aren’t suffering by not moving to fill it. Jonathan Smoke, Cox Automotive chief strategy officer, tells the Times, “Spending is consistently being driven by high-end consumers. Lower-income households continue feeling the strain of stretching their paychecks.”

Americans bought about 16.3 million cars in 2025. They will likely purchase fewer in 2026. Cox Automotive predicts sales of about 15.8 million as economic uncertainty sees some Americans tightening their spending. But that figure, the Times notes, is “not far from the 16 million threshold that industry executives consider a good year.”

The credit market is also keeping some shoppers home. “The average interest rate on car loans is 9.3%, up from 8.7% a year ago,” the Times notes. The Federal Reserve reduced its benchmark interest rate in December, its third consecutive rate cut. But the auto loan market has not moved in concert with the Fed in recent months.