Back in 2010, Über was just a small San Francisco startup, shuttling a few thousand people around town and only beginning to make ripples. Fast forward four years and the transit-app company, recently valued at $18.2 billion, has grown to become the world’s most valuable startup, serving millions of riders across 128 cities and 37 countries.

So how did Über do it? The company took to the cities, embraced a growing distaste for the problems associated with short-distance urban commuting, and has provided a simple, convenient, and – most importantly – cost-effective way to get around.

And it doesn’t appear to be stopping anytime soon. In a recent interview with CNN, Über CEO Travis Kalanick confirmed that the company doubles its revenue every six months and exchanges billions of dollars in transactions a year, though Über has declined to release exact global figures.

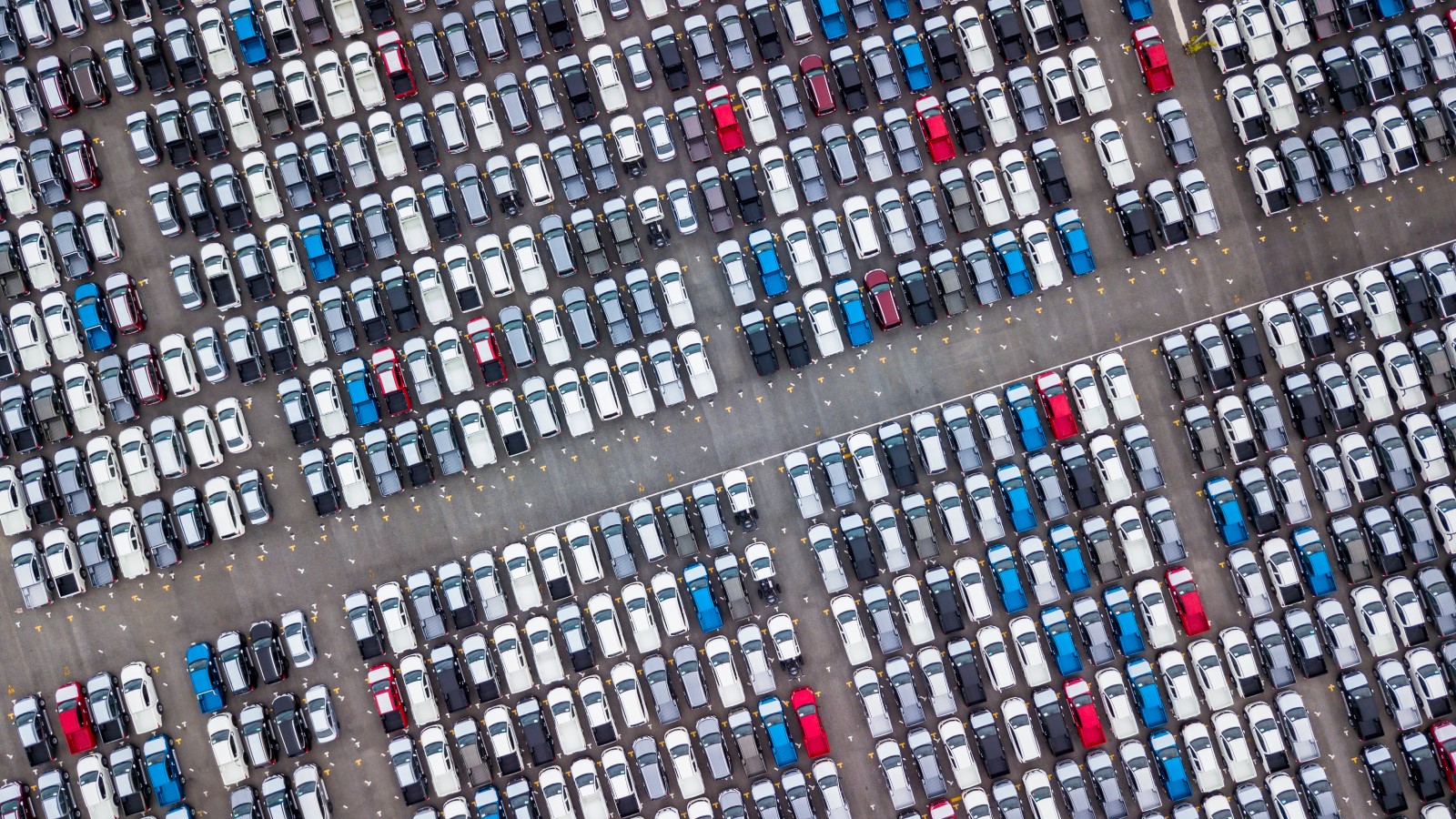

Car Sharing Wave

However, it isn’t just the recent influx of app-based transportation services that have automakers taking note, but established on-the-ground car-sharing services as well, such as Zipcar. According to a study released by AlixPartners, which surveyed drivers in 10 U.S. metropolitan car-sharing cities, each shared fleet vehicle displaces about 32 personal-vehicle purchases. This accounts for approximately 500,000 vehicle purchases avoided in the past decade and projections that suggest 1.2 million sales could be avoided through 2020.

Also: The Class of 2015 — New Vehicles Ready to Roll

"The study suggests that car-sharing nationally could scale up as these 10 markets have," notes Mark Wakefield, managing director at AlixPartners. "And if that happens, the impact on the traditional automotive market could be explosive."

Add those figures to the rampaging success of Über and Lyft, and car ownership could be evolving into more of a luxury than a necessity. The overarching reason for car-sharing remains its economy. If commuters don’t mind waiting a few minutes to get on the road or perhaps only take occasional short trips, the costs of hiring a ride outweigh the thousands of dollars a year spent on car payments, fuel, maintenance and insurance of a personal vehicle.

This may also affect the types of vehicles sought by city dwellers with access to car services or sharing. They may opt for a larger weekend car for long distance travel if they have access to a shared city car, mass transit or car services. Conversely, they may opt for small city cars and use car sharing for a larger vehicle for trips out of the city. BMW offers its i3 EV owners access to occasional use of X5 SUVs.

Millennials a Driving Force

Über also offers multiple levels of transportation – from the bargain-priced Über X to the posh Über LUX service – the car service has created pricing and a level of refinement for every economic stratum. The company recently slashed its base prices by 20 percent in New York City (to levels lower than taxi fares) and by 25 percent in San Francisco and Los Angeles.

"In terms of what patterns will predominate, people will vote with their wallets," comments Eric Carlson, who heads VW Group’s market research in the US. "The need for owning a car, which was the only way to address certain issues years ago, is now being supplanted by other ways in which you can address those requirements."

Higher Vehicle Costs a Factor

These money-saving benefits have helped contribute to the idea that millennials, which now comprise the largest generation in U.S. history, have become disenchanted with car ownership. Whether true or not, many millennials simply don’t have the money to buy today’s newer more expensive vehicles, especially going forward as more advanced and costly technology is implemented to improve fuel economy.

"Whether it’s stop-start systems, more advanced engine management, or turbochargers, it will get us to where we need to be for compliance, but there’s a price to pay," says Carlson.

Also: The 12 Best Family Cars of 2014

And according to a survey conducted by U.S. PIRG, a nonprofit consumer group, millennials aren’t willing to pay it. Young Americans (ages 16 to 34) drove 23 percent fewer miles in 2009 than in 2001, equaling a benchmark set in 1996. If the trend continues downward, total vehicle travel in the US could remain below its peak set in 2007, all the way through 2040 despite a 7 percent population increase.

Automakers Adapt

The shift away from driving hasn’t thrown global automakers into a panic just yet, especially since many Über and Lyft users own a car but choose to use the app for convenience – for instance, taking a one-way trip or as a way to avoid impaired driving.

But the trend has caught on with a few automakers. Daimler operates its Car2go rental program in a number of major US cities, comprised of a fleet of Smart Fortwo city cars. BMW’s DriveNow program allows residents of the San Francisco Bay Area to book a BMW ActiveE coupe when they so desire.

And most recently, General Motors and Toyota will begin offering Über drivers discounted financing on select new vehicles approved for use with ÜberX. It might be a long way off, but if these partnerships continue to propagate, we could eventually see fleets of autonomous Über-tasked Google cars shuffling commuters around. Google did invest $258 million into Über last year anyway. It’s in each automaker’s best interests to adapt to and understand the changing dynamic of car ownership. At its onset, Über set out to redefine how people get from point to point. So far, it is.

Popular at KBB.com

10 Best Sedans Under $25,000

10 Best SUVs Under $25,000

The 40 MPG Cars of 2014

-180.jpg)