An emerging theme in the broader electric vehicle (EV) debate says Toyota was wise to hold off on going electric. That story grew complicated this week as Toyota pulled back and pushed forward in its EV strategy.

Did Automakers Overshoot on EVs?

Americans bought more than 300,000 EVs last quarter, according to Kelley Blue Book parent company Cox Automotive. EVs made up 7.9% of all car sales between July and September — a jump of 0.7% from second-quarter numbers setting a new record.

EV sales have shown steady growth for a decade now. Americans have never, in that time, bought fewer than they purchased the quarter before.

But automakers have overshot their early expectations for EV growth this year.

Dealers vary widely in the number of EVs they stock. A dealership in an East Coast suburb and a dealership in rural Wyoming know they’ll see different demand and plan accordingly.

But earlier this summer, some dealers began to report that they had more EVs than they could sell.

That trend hasn’t reversed. Automakers now find themselves trimming their short-term EV plans. Ford and GM last month scaled back plans for electric truck sales and slowed factories.

Toyota Bet on Hybrids

Toyota has plans to go electric, just like every other automaker. But in these early days of the EV transition, the company bet heavily on hybrids instead.

That has proven wise, some suggest.

Researchers from GlobalData report that U.S. hybrid sales have more than doubled in the last three years. Americans are on pace to buy 35% more hybrid-electric vehicles this year than last.

As of May, four of the 10 best-selling electrified models (a category that combines EVs, hybrids, and plug-in hybrids) were Toyota hybrids.

But It Dives Into EVs As It Pulls Back

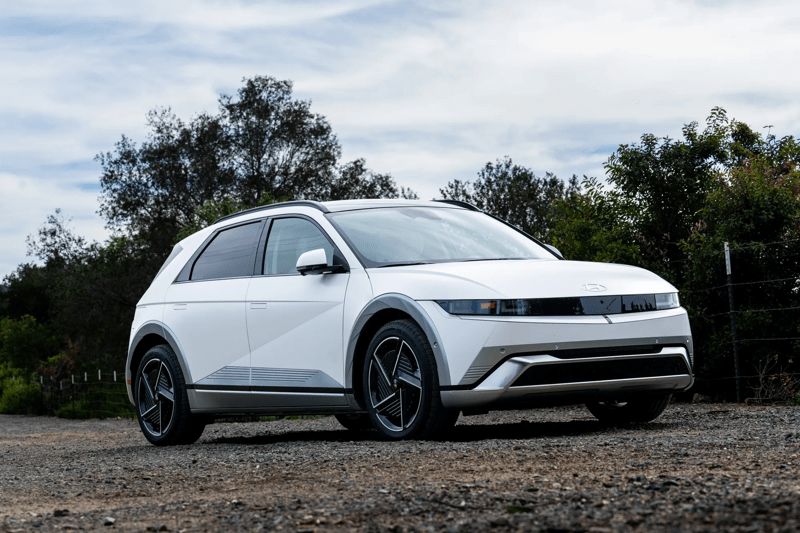

That has led many observers to conclude that Toyota was wise to move slowly on EVs. The company sells just one electric car in the U.S., the bZ4X compact SUV it developed with Subaru. In terms of sales, it’s a relatively minor part of Toyota’s portfolio.

But the company took two significant steps this week that paint a mixed picture.

The company posted its second-quarter financial results and, in the process, lowered its forecast for how many EVs it expects to sell this year by nearly 40%. Rather than 202,000, Toyota expects to sell 123,000 EVs globally this year.

You may think Toyota is pulling back from EVs and doubling down on its successful hybrid-based strategy.

However, the automaker revealed Tuesday it plans to invest $8 billion into its battery manufacturing facility in North Carolina, currently under construction. The automaker announced plans to build a $1.29 billion plant in 2021. Still, demand for EVs and hybrids had Toyota revising the agenda— and funds invested — since then so that now the total commitment is $13.9 billion. It’s the company’s single most significant investment in the U.S.

Toyota is adding eight production lines for battery-electric and plug-in hybrid electric vehicles, bringing the total to 10 lines. It will also boast four lines for hybrid electric vehicles, the company noted. Initially expected to employ 1,750, the site will now have 5,000 workers, Toyota officials said.

It’s About Short-Term Thinking

Why invest more in EVs even as the rest of the industry seems overinvested?

Chris Hopson, an analyst at S&P Global Mobility, told industry publication Automotive News that EV growth is “not going to be a tidal wave immediately. It’s going to be a rising tide.”

Prices and charging infrastructure still make EVs impractical for many. But the price of the average electric car has come down more than 20% this year. And nationwide charging infrastructure is in its infancy but stabilizing and growing. Almost every large automaker has finally adopted a standardized charging plug this year, Tesla’s North American Charging System.

Toyota’s decisions reflect that reality. The company has cut its short-term EV sales forecast and invested more money in EV production for the long term.

“Since this is such a huge transition, we’re going to have all kinds of bumps in the road,” says Stephanie Valdez-Streaty, director of industry insights for Cox Automotive. Those bumps don’t stop the road from going where it goes.