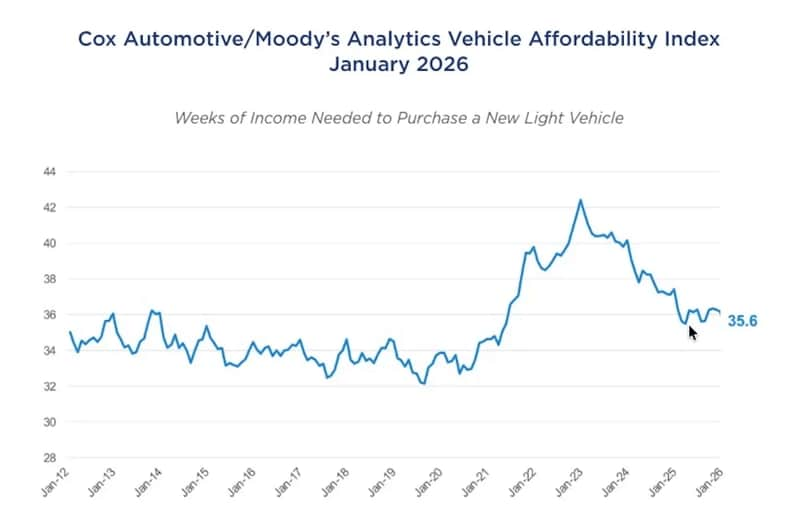

- The average earner would have to work 35.6 weeks to pay off the average new car bought in January.

- That’s an improvement, but mostly a cyclical one, as it usually improves this time of year.

A new car represented 35.6 weeks of work for the average American last month. That’s an improvement – it stood at 36.2 weeks in December.

It’s also typical. The figure usually drops in January, as Americans often buy more luxury cars in December, inflating affordability numbers.

You pay for a car with money, but most of us also pay with our time. Few Americans can buy a new car outright in a market where the average sale price last month was $49,191.

So most of us borrow to buy, and work to pay off the loan.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index tracks that, measuring how long the average earner would have to work to pay off the average new car loan. It’s a product of Kelley Blue Book parent company Cox Automotive.

Related: Is Now the Time to Buy, Sell, or Trade-In a Car?

The index hovered between 33 and 36 weeks for about a decade before the COVID-19 crisis upset the car market. It peaked at 44 weeks in December of 2022.

It is now back to the high end of normal, with no guarantee that will last.

The typical monthly payment decreased 1.4% to $756, which was up 1.7% year over year but at the lowest monthly payment since last March.