Update 10/4/2024 — The strike is over thanks to a tentative agreement on wages that extends the union’s contract through January 15, 2025. Negotiations on other outstanding issues will continue, according to a statement released by the International Longshoremen’s Association, but the strike is over, for now. “Effective immediately, all current job actions will cease and all work covered by the Master Contract will resume,” the union announced in its statement.

Update 10/1/24 — The strike began at midnight, as dockworkers walked off the job from Maine to Texas. The Washington Post reports, “The strike caused immediate disruptions at ports that handle more than half of the United States’ trade in cargo containers. The effects are expected to ripple through the country, costing at least hundreds of millions of dollars a day and getting worse each day the longshoremen remain off the job.” The two sides have resumed negotiations.

A looming strike at American ports could slow the import of new cars and parts to build them, making new vehicles from some brands hard to find.

According to the New York Times, “Businesses are preparing for a strike by dockworkers on the East and Gulf Coasts, which could begin October 1 if negotiations don’t yield a new contract.”

Related: Is Now The Time To Buy, Sell, Or Trade-In A Car?

East and Gulf Coasts Affected

The International Longshoreman’s Association (ILA) union represents the dockworkers who load and unload goods at most ports on the East and Gulf Coasts. A separate union, the International Longshore and Warehouse Union, represents most West Coast dock workers. West Coast workers have a contract and are not poised to strike.

The ILA and the United States Maritime Alliance, which represents dock employers, are at a stalemate over wages.

$5 Billion a Day at Risk

The Orange County Register explains, “The two sides remain far apart. The union is demanding a near-80% raise over six years, arguing workers deserve a share of profits won by foreign-owned container carriers during the pandemic. Reluctant to set such a precedent — and with some reserves in the bank — companies could wait it out longer than usual.”

Even a short strike could be devastating for the economy. “JPMorgan transportation analysts estimate that a strike could cost the economy $5 billion a day, or about 6% of gross domestic product,” the Times reports.

Auto Industry Preparing

Foreign automakers bring thousands of cars a day through U.S. ports. A strike would stop that flow on two of three coasts. Many domestic car factories also depend on shipments of parts that come in through the ports. A strike might temporarily shutter some American factories that couldn’t get the parts they need to work.

The auto industry has recent experience with shipping problems.

Car imports were snarled in March when a container ship hit a support column on a bridge in the Port of Baltimore, sending the span into the water and closing parts of the port. Automakers also learned logistics flexibility from the late COVID-19 pandemic, when parts supplies could be sporadic.

Automotive Logistics magazine reports that some companies are turning to air freight this time “to mitigate the impact of port closures.” Air traffic can’t replace the shipping volume but could allow some parts to flow. Others have shifted shipments to West Coast ports.

That solution has limits, though, as those ports could back up with traffic. The Times notes, “The ports of Long Beach and Los Angeles say they are handling at least as many containers as they did during the pandemic shipping boom of 2021-22.”

Inventory Problems Likely For Some Brands

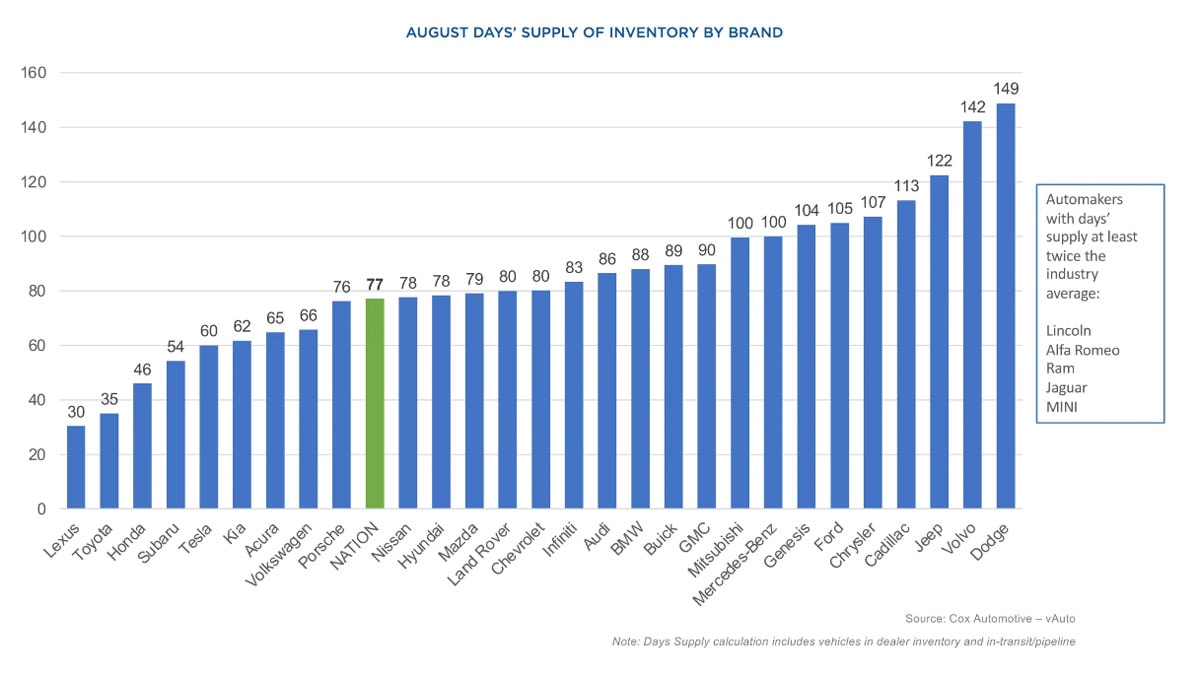

Some car brands are well-equipped to weather shipping problems and factory shutdowns due to parts shortages. They already have more cars in stock than they want.

Stellantis, the parent company of Chrysler, Dodge, Fiat, Jeep, Ram, and other brands, is already fighting an inventory glut with heavy discounts. Reuters reports that the company “aims to cut 100,000 vehicles from its U.S. inventories by the start of next year” through discounted sales and production slowdowns. Shoppers likely wouldn’t struggle to find those vehicles unless a strike lasted weeks or months.

Related: Discounts On New Cars 50% Higher Than A Year Ago

Others, however, are already short of cars. Toyota, Lexus, Honda, and Subaru are already well under traditional industry inventory targets. A shortage of new vehicles could leave dealers at all four brands with minimal inventory. Shoppers could struggle to find the vehicle they want from those brands and see higher prices for the cars dealers did have in stock.