America’s automakers used to have an inventory glut. It’s gone. The average brand entered May with fewer cars in stock than traditional industry guidelines tell them to keep.

News of auto industry tariffs sent Americans flocking to sales lots in March and April to buy the last cars imported at pre-tariff prices. This has drawn down inventories and brought dealerships closer to the day they need to stock cars imported at higher, tariffed prices.

Related: New Car Prices Started to Inch Up in April

Below the Inventory Sweet Spot

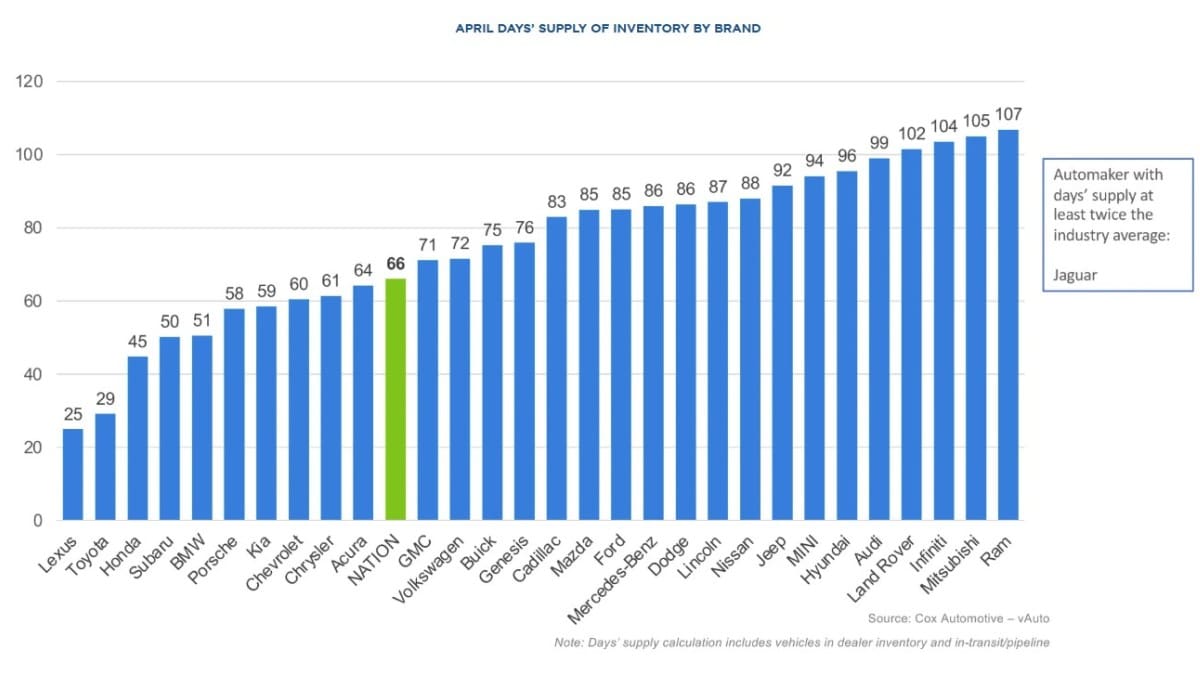

On average, automakers ended April with just 66 days’ worth of new cars in stock, according to data from Kelley Blue Book parent company Cox Automotive. An old industry rule of thumb tells dealerships to aim for 75 — 60 on the lot and another 15 in transit.

Fewer means your local dealership might not be able to get the combination of colors and options you want in a car. More costs them money. Dealers generally make payments on the cars on their lots through a complex loan arrangement. The longer a car sits unsold, the harder it is for them to profit from its sale.

Automakers ended February with an 89-day supply, on average. Many were discounting cars at the time to try to clear the backlog. Incentives made up 7.1% of the average new car sale then, but more than 10% at some overstocked brands.

Related: Is Now the Time to Buy, Sell, or Trade-in a Car?

Then the White House announced tariffs on new cars and parts to build them with. The sales rush started in March. Automakers ended that month with 70 days’ worth on average.

Sales slowed a bit in April but remain above normal rates. The average automaker ended that month with just 66 days’ worth of cars to sell. Incentives have fallen to 6.7% of the average sale price.

Not Every Brand Is Running Short

It’s still easy to find pre-tariff cars from some brands. A handful remain overstocked by traditional standards. Others are well below normal already.

Toyota and its Lexus luxury arm have the tightest supply in the industry – 29 and 25 days, respectively.

Related: How Each Car Brand is Handling New Tariffs

At the other end of the scale, Ram dealers still have 107 days’ worth of vehicles to sell. Mitsubishi dealers have 105. Jaguar is off the chart, but a special case, as the company is revamping its lineup completely and has stopped building most models. It plans to re-emerge with a more expensive, exclusive lineup.

What the Numbers Mean for You

Inventory figures are more useful than ever for car shoppers.

Automakers and their dealers don’t necessarily have to pass on the full cost of the new tariffs to shoppers. But the automotive industry runs with fairly tight margins — neither factories nor dealerships can afford to sell tariffed cars without a markup for long.

But lots, today, aren’t necessarily full of tariffed cars. Some dealerships still have a healthy supply of cars they bought at pre-tariff prices, and could for as long as three months. Others are facing the day when they have to restock at the new, higher prices in less than four weeks.

They’ll all have to raise the prices they charge as that day approaches. Knowing when it’s coming gives you leverage – or, for some brands, tells you you don’t have it.