The rates are reshaping the auto industry, says Cox Automotive Chief Economist Jonathan Smoke.

Coming Soon: Highest Auto Loan Rates in Decades

“Auto loan rates have moved higher by a bit more than three full percentage points so far and likely have another one to two points to go before they peak. That level of rates has not been seen in more than 20 years,” Smoke says.

Cox Automotive is the parent company of Kelley Blue Book.

The Fed projects that it will increase rates by another 75 basis points before they peak and that the moves will raise the unemployment rate to 4.6% by the end of 2023. That, federal officials believe, will help rein in inflation. But it will also mean at least 1.5 million job losses in 2023, Smoke says.

We Seem Locked in a Cycle of Rising New Car Prices

“A weak economy with job losses is not good for vehicle demand. Payment affordability will be much more of an acute challenge in 2023 than what has been experienced over the last two decades,” he explains.

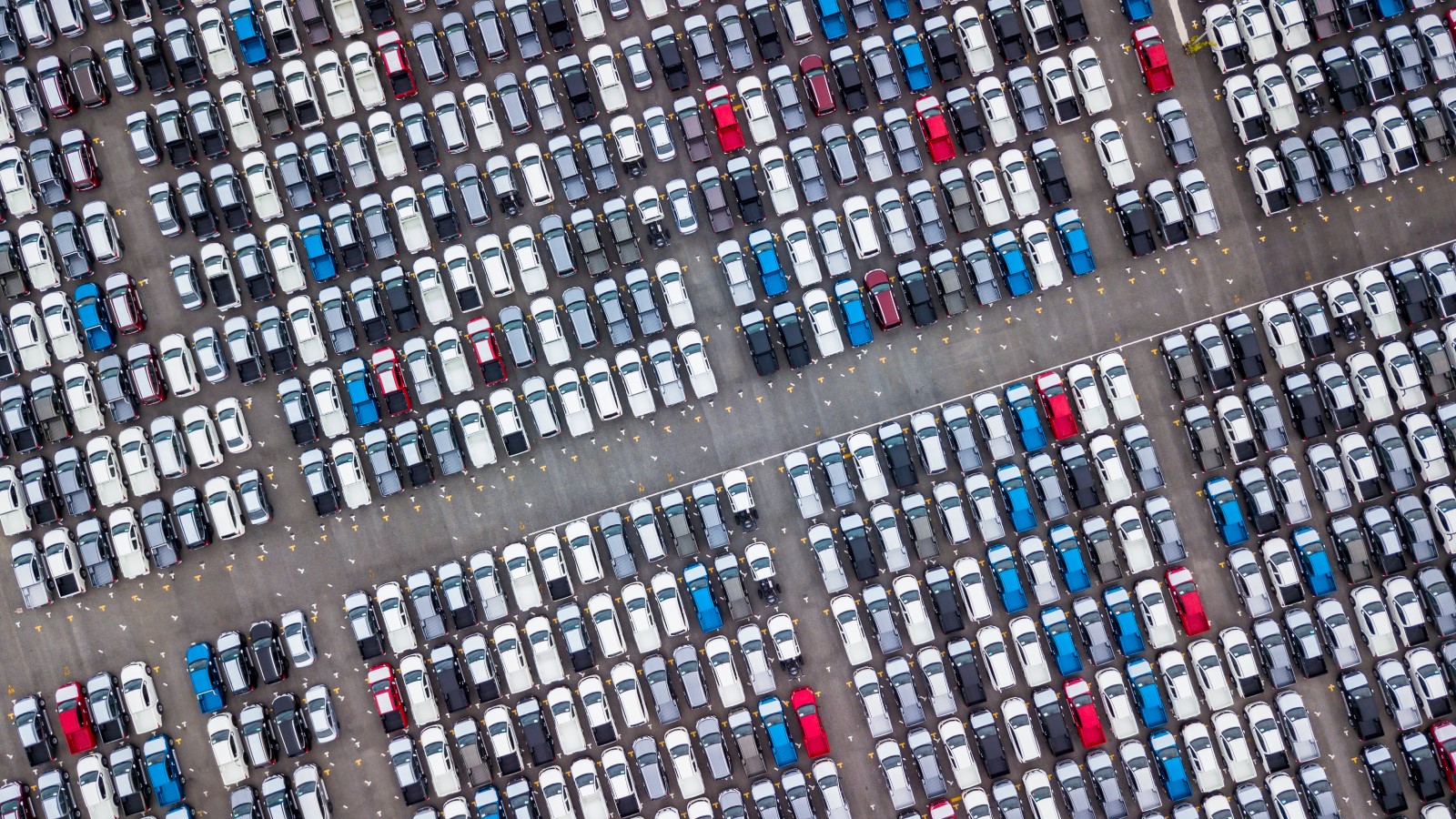

That creates a cycle that pushes new car prices higher. Automakers will understand that only high-income buyers with good credit can afford new cars and will build more expensive luxury cars to meet that market’s desires.

New car prices hit a record high in November. The Fed’s move will likely mean more record highs next year.

Falling Used Car Prices Will Provide Relief for Some

“The only hope for relief in the near term will be in the used market, where used-retail prices are finally starting to decline at an accelerating pace following a 13% decline in wholesale values this year since May,” Smoke says.

Used car retail prices, he says, could fall “for much of the next year,” helping to “bring down overall consumer inflation.”

The news may remain good for used car shoppers for some time, he says. “Once rates peak and stabilize, depreciation will increasingly produce buying opportunities in the used market. Those opportunities will help to stabilize vehicle values and return the market to seeing normal depreciation rather than the abnormal increases and decreases the market has experienced since 2020.”

This Pattern Could Last for Years

But new car shoppers will continue to see prices spiraling higher. The Fed, Smoke says, is “reducing demand and tilting the new market to further favor wealthy consumers.” That means that the supply of new cars “will take longer to normalize” than it otherwise would. The auto industry and the drivers who depend on it “will be living with the aftereffects of this rate roller coaster ride for several years to come.”