Amid an escalating trade war, China has banned the export of some minerals used in electric vehicle (EV) batteries to the U.S.

We’re still learning the implications of the tit-for-tat on American consumers.

However, the move may affect the EV market less than it would have earlier because automakers have used fewer Chinese minerals in their batteries over the past two years as they worked to comply with American law.

The Trade War

China’s move comes in response to an American decision. The Associated Press explains, “The Chinese Commerce Ministry announced the move after Washington expanded its list of Chinese companies subject to export controls on computer chip-making equipment, software and high-bandwidth memory chips.”

On Monday, the Commerce Department announced a major set of export restrictions aimed at curbing China’s attempts to make more sophisticated microchips. These so-called “dual-use” technologies could be used in consumer products or military equipment.

In response, China launched its own restrictions on materials it says the U.S. could use for military purposes. The move, Reuters explains, “banned exports to the United States of items related to the minerals gallium, germanium, and antimony” and “requires stricter review of end-usage for graphite items shipped to the U.S.”

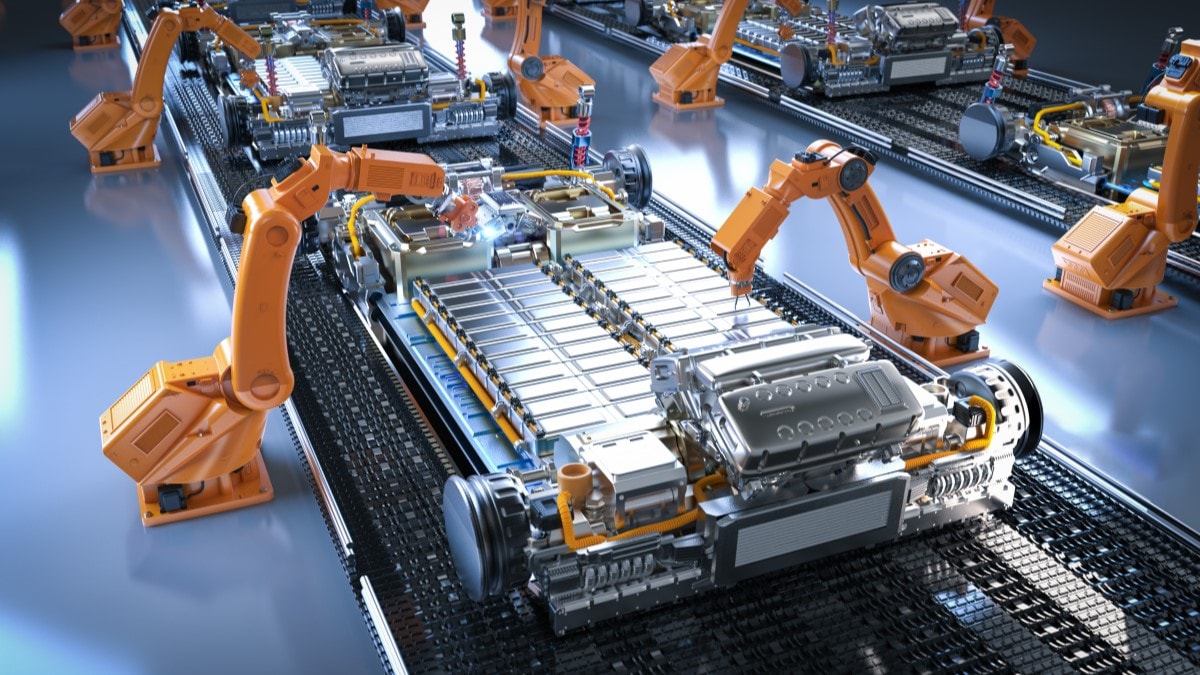

Many of the minerals included in the ban are used in electric vehicle batteries.

EV Tax Credit Law Curbing U.S. Dependency on China

China’s move could impact dozens of products American industry depends on. But the effects of a ban would have been much more severe a year or two ago.

Reuters notes, “Chinese customs data show there have been no shipments of wrought and unwrought germanium or gallium to the U.S. this year through October, although it was the fourth and fifth-largest market for the minerals, respectively, a year earlier.”

Why? Partly thanks to the law that created the current EV tax credit system.

The law allows Americans to claim a tax credit of up to $7,500 on the purchase or lease of many electric cars. But it has required automakers to shift more of their supply lines away from China each year since its 2022 passage.

Related: How Do EV Tax Credits Work?

A car qualifies for half the credit if at least 60% of its battery is built in North America. It qualifies for the other half if at least 50% of the critical minerals used in that battery originate in the U.S. or certain trade partners.

Those requirements increase by 10% each January. That means automakers can rely on lower EV prices, and the increased sales that result, as long as they keep shifting supply lines away from China.

The move has worked – many automakers have opened new car and battery plants in America in response.

Global Supply Chains Shifting

China still dominates trade in some rare earth minerals, in part because its auto industry has quickly become the world’s largest.

However, demand for non-Chinese minerals to comply with the law has spurred other countries to create their own tradeable supplies. A European metals trader told Reuters that, in response to this week’s actions, “Everyone will dig in their backyard to find antimony. Many countries will try to find antimony deposits.”

The AP notes, “The U.S. has deposits of such minerals but has not been mining them, though some projects underway are exploring ways to tap those resources.”