- Car dealers now have a normal number of cars in stock, which is good for prices

- But tariffs still threaten inflation

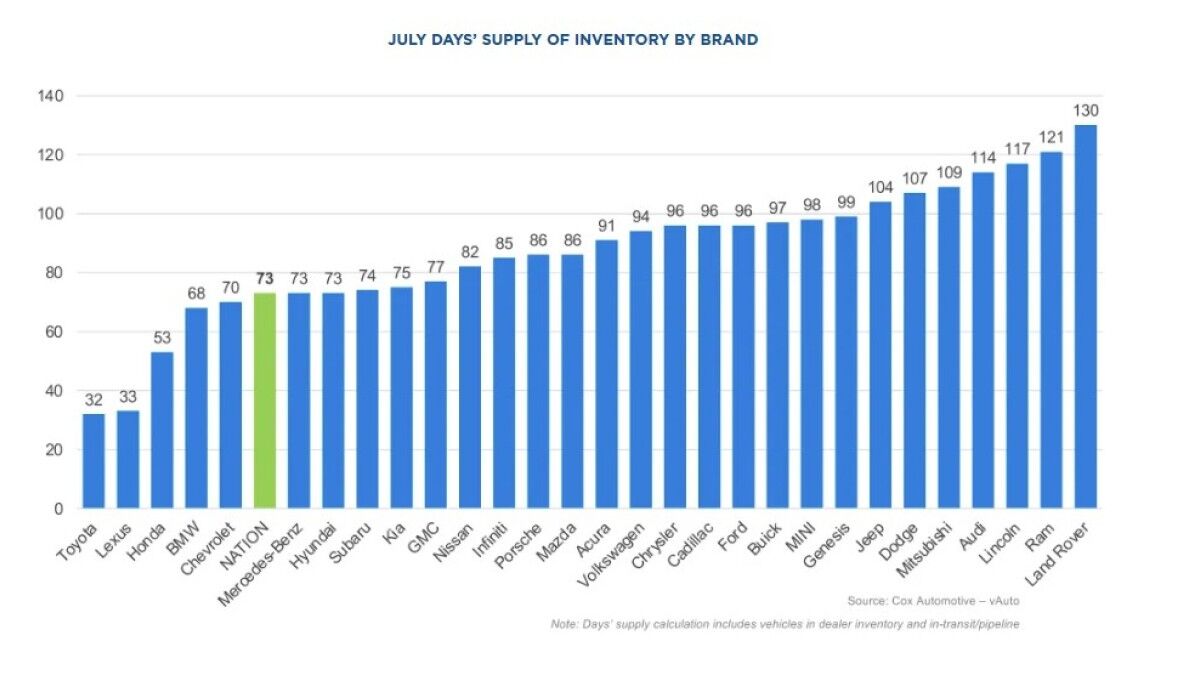

America’s car dealers have almost as many cars in stock as they did before tariffs rocked the auto industry. The average automaker now holds a 73-day supply of new cars — roughly the figure they traditionally aim for.

That’s good news for shoppers, as it helps keep prices stable. Tariffs could still cause price increases as automakers adjust to the reality that they’re here to stay.

The Supply Side of Pricing

- The supply of new cars dipped early in the trade war

- It has returned to baseline

Car prices are set by supply and demand, so inventory (supply) is a significant factor in how much car shoppers should expect to pay.

Dealers traditionally aim to keep about 60 selling days’ worth of inventory on hand, with another 15 days on order or in transit from factories. In March, when most automakers paid just a 2.5% tariff to import cars to the U.S., the average automaker had slightly overshot. They had an 89-day supply (including those in transit) and were discounting cars to get back down near 75.

Then, President Trump announced 25% tariffs on most new cars and car parts. That threatened to raise car prices.

Tariffs triggered a minor sales rush as Americans sought to buy cars imported at pre-tariff prices. By the start of May, inventories had fallen to just 66 days.

Each automaker responded to the tariffs in its own way. Some held off shipping cars to the U.S., waiting for negotiations to settle on a permanent tariff rate. Some brought vehicles to the U.S. but stored them at ports, knowing they wouldn’t pay the higher tariff until the cars left storage. Others continued shipping as they normally would.

Now, the White House has signed trade deals with many countries, and automakers have adjusted their strategies. The average car company now has a 73-day supply.

Prices Fairly Stable, but Threats Remain

- Prices haven’t changed much despite shifting tariffs

- Ironically, stability may bring price increases

Almost all car companies held off on major price increases, with automakers and dealers absorbing as much of the tariff cost as possible. The average new car sold for just 1.5% more last month than it did a year ago.

Now, a new normal is starting to settle in. Many countries have signed new trade agreements with the U.S. British cars now come in at a 10% tariff. Deals with the European Union, Japan, and South Korea let cars from those countries in at a 15% tariff.

Cars from elsewhere, including many Canadian and Mexican factories owned by American automakers, are still tariffed at a 25% rate.

With long-term deals in place, automakers have warned they may have to begin to raise prices. Neither dealers nor factories can absorb tariff costs forever. The arrival of the 2026 model year also gives automakers the chance to adjust prices.

Situation Differs Brand to Brand

- Some brands are still much lower, others much higher than the target

If you’re car shopping, knowing the supply situation of the dealer you’re working with helps you understand your negotiating power.

Some brands are still very lean on supply. Toyota and its Lexus luxury marque tend to run the tightest inventory in the business, and both have barely a month’s worth of cars to sell at the moment. Those dealers know that, if you don’t buy the vehicle you’re negotiating over, they won’t have trouble finding someone else who wants it.

Others are well over target. Ram and Land Rover each have at least a 4-month supply. Their dealers may be more anxious to move metal and willing to offer discounts.