America’s average new car buyer paid $49,388 in January — down 0.6% from December’s record high. Prices remain 5.9% higher than one year ago.

New vehicle prices have now been higher than sticker prices for more than a year. In January, the average buyer paid $310 more than sticker price.

“The transaction data from January indicates that overall prices are no longer increasing like they were a year ago,” said Rebecca Rydzewski, research manager of economic and industry insights for Kelley Blue Book’s parent company Cox Automotive.

The news comes after several rounds of Federal Reserve interest rate increases meant to force big-ticket items’ prices down.

Most Affordable Carmakers Saw Prices Fall

Most non-luxury brands — including Chevrolet, Chrysler, Dodge, Ford, Honda, Kia, Mazda, and Subaru — saw transaction price declines between 0.3% to 4.9% month over month.

Toyota and Ram showed the most price strength in the non-luxury market, transacting between 2% and 5% over sticker price in January.

Luxury Cars Made Up a Record Percentage of Sales

Nearly 20% of the new cars Americans bought last month were luxury vehicles — a record high. The high percentage of luxury sales, Rydzewski said, “helped keep the overall average price elevated.”

Mercedes-Benz and Lexus showed the most price strength in the luxury market, transacting between 1.4% to 4.8% over sticker price last month. Luxury brands Audi, BMW, Infiniti, Lexus, Lincoln, and Volvo showed the least price strength, selling 1% or more below the manufacturer’s suggested retail price (MSRP) in January.

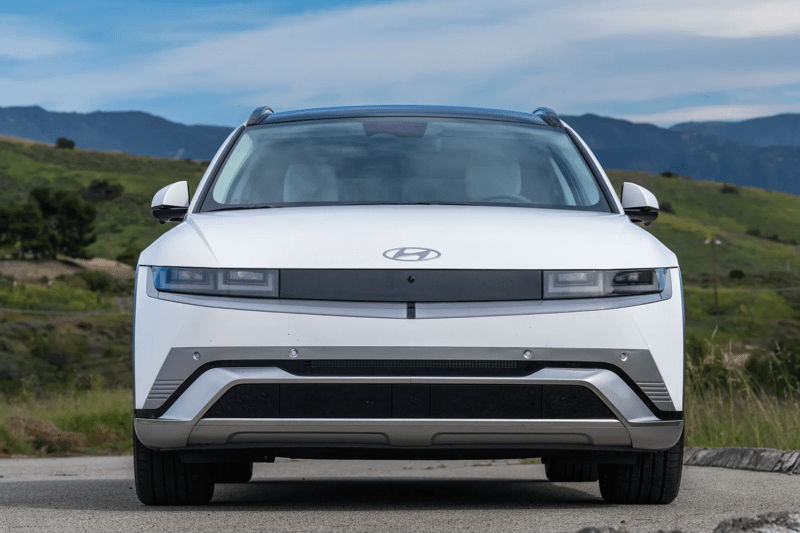

Electric Car Prices Dropped Dramatically

Prices for electric vehicles (EVs) dropped significantly during the month. Tesla cut prices on some models up to 20%, partly in response to a new law capping EV prices that qualify for federal tax rebates. Ford followed suit with a price cut on America’s best-selling non-Tesla EV.

Those cuts combined drove the average EV sale price down by $3,363 (down 5.4%) compared to December.

Incentives Returning, but Still Historically Low

Incentives increased in January 2023 to 2.8% of the average transaction price, compared to 2.7% in December.

In January 2021, before the new-vehicle inventory decline, incentives averaged 8.6% of ATP, according to Kelley Blue Book estimates.