Quick Facts About the Buying and Selling Marketplace

- December saw the average new car’s price reach an all-time high.

- Used car prices rose as well last month.

- The credit market remains good for borrowers, with lower rates likely ahead.

Affordability is the watchword in American life right now, and nowhere is that truer than in the car market.

The price of the average new car reached an all-time high in December: $50,326. Used car buyers didn’t see a record last month, but they did see prices increase, with the average used car listing for $26,043.

Not all the news is bad. Credit is easy to come by, rates are expected to improve early in 2026, and wage growth offsets the price increases for many.

In early 2026, car shopping requires careful research and planning. But it’s not all unpleasant. A recent survey found buyers growing more satisfied with the shopping experience.

We’ll explain what to expect when buying a new or used car, or selling or trading one in, and why it might make sense to act quickly.

- What New Car Shoppers Can Expect

- Each Automaker Is Responding Differently

- What Used Car Shoppers Can Expect

- Older, Less Expensive Cars Harder to Find

- Automakers Are Building More Expensive Cars

- How to Buy a Car Right Now

- Selling a Car Right Now

- Trading in a Car Right Now

- Looking Ahead

- Tips for Buying a Vehicle Right Now

What New Car Shoppers Can Expect

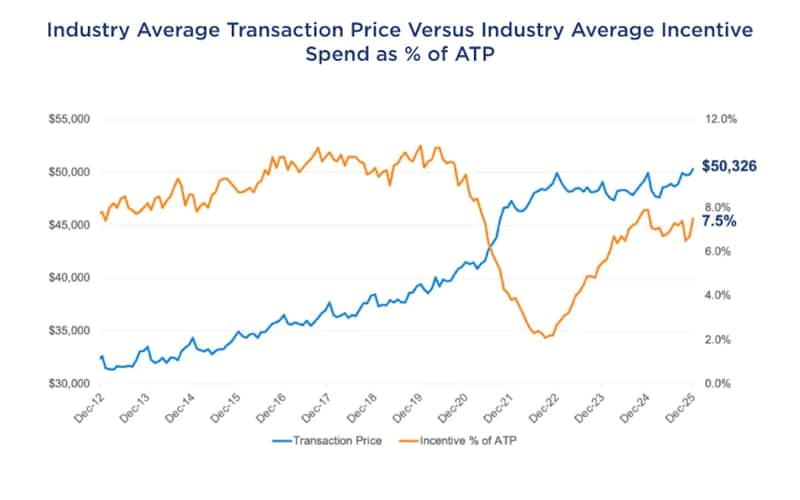

The average new car sold for $50,326 in December — a record high. Dealers did what they could to help, increasing the average discount to about 7.5% of the purchase price. But there’s no way around it — new cars are more expensive than ever.

That’s partly due to consumer choice. Shoppers bought more full-size trucks than at any point in the last five years, with the average big truck selling for $66,386.

It’s also due to manufacturer choice. As 2026 models reach sales lots, automakers are increasingly passing the cost of tariffs on to the car shopper.

Automakers are tailoring their lineups for a market in which households making $150,000 or more buy 43% of new cars. As the year ended, Nissan canceled the last new vehicle with a sub-$20,000 price tag.

RELATED: When Will New Car Prices Drop?

Yet much of that cost is in your control as a shopper. You can keep prices reasonable by choosing only as much car as you really need, and by paying attention to supply at the brands you’re considering.

Dealers typically aim to maintain a 60-day supply of new cars on sales lots, with an additional 15 days on order. The average automaker is almost spot-on this month with a 76-day supply.

However, that average is made up of extremes. Some have barely (or even less than) a month’s worth on the lot. Others have a surplus and are looking to make deals. Shopping outside your preferred brands could save you thousands.

Each Automaker Is Responding Differently

Car pricing is complicated, and each automaker has responded to tariffs differently. As long as the tariffs remain, the response will likely shift constantly.

Some, like Hyundai and Mercedes-Benz, pledged not to raise prices at first, though increases are trickling in with the model-year change. Others are deciding on a case-by-case basis.

RELATED: How Each Automaker Is Responding to Tariffs

Automakers have absorbed some of the cost of tariffs for a while. They might even respond by raising the price of one car to help pay the tariff on another.

With so much constantly shifting, your best tool for understanding local price changes is the Kelley Blue Book Fair Purchase Price, which we calculate using recent transactions for that car in your area. We update each Fair Purchase Price weekly, showing you how tariffs and tariff anxiety are impacting the prices of the specific vehicles you’re shopping for where you live.

Loan Conditions Are Improving

Prices are all that cash buyers need to worry about. However, few car shoppers are cash buyers. Most Americans borrow money to buy a new car.

On that front, the news is good. Americans had an easier time qualifying for car loans in December than in any month since October 2022.

Lenders approved 73.7% of applications in December. They accepted lower down payments — just 13.3% of loan value, and were more likely to extend loans for 72 months or longer (a mixed blessing, as it keeps monthly payments lower but costs you more in interest over time).

The Federal Reserve, commonly called “the Fed,” has also played a role. The Fed sets the federal funds rate, the interest rate banks use when they lend each other money. The federal funds rate determines interest rates for every type of loan, including car loans. It’s still on the way down, which should ripple through the economy over the next few months.

The Fed has now cut rates at its last three consecutive meetings. Rate cuts typically take a few months to reach shoppers, so the best rates may still come in early 2026.

What Used Car Shoppers Can Expect

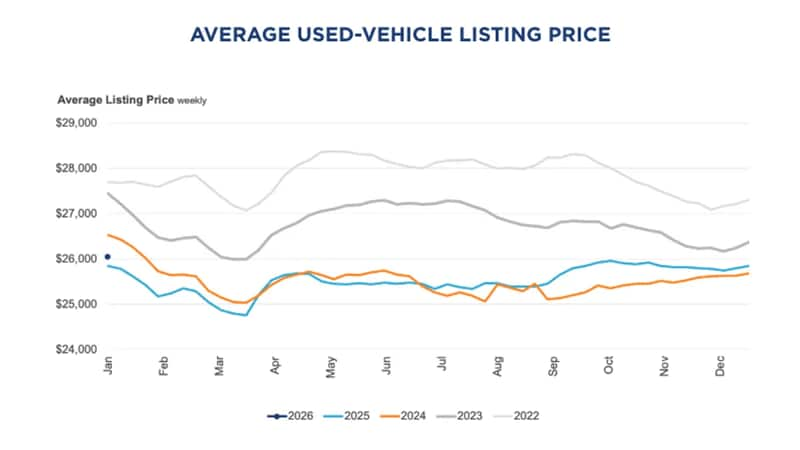

The average used car listing price was $26,043 in December. That’s 2% higher than November’s figure, and 3% higher than a year ago.

Supply and demand govern used car prices, and supply has proven steady.

The nationwide supply of used cars has been thin for years. Pandemic-era disruptions meant automakers built about 8 million fewer cars than they normally would have in 2021 and 2022. Millions of cars will never reach the used market, keeping supplies low for a long time.

But the problem is beginning to ease. Dealers ended December with 5% more cars in inventory than they had the month before.

Older, Less Expensive Cars Harder to Find

If you hope to find an older vehicle and your budget is less than $15,000, these cars remain in short supply. Dealers have just 38 days’ worth of used cars priced under $15,000 — 14 days below the overall industry average.

However, the tariff threat could push used car prices higher. When new car prices rise, would-be new car shoppers head to used lots looking for something still in their price range. More would-be new car shoppers start buying up the available used vehicles, drawing down the inventory. Plus, Americans are holding onto their cars longer than ever. The average vehicle on American roads is 12.8 years old. Automakers also produced fewer cars for several years after the 2008 recession, leaving fewer higher-mileage, older used vehicles available to sell.

The most accessible used cars carry prices between $15,000 and $30,000.

Automakers Build More Expensive Cars

If you haven’t been car shopping in a while, the cars on offer may surprise you.

In recent years, inexpensive cars have grown scarce. Recent analysis finds that sales of vehicles priced at $25,000 or less have fallen by 78% in just five years. Six years ago, automakers offered 36 new models in that price range. Today? Four.

At the other end of the scale, in 2017, they built 61 models priced at $60,000 or more. This year, they built 114.

Dealers are pushing back, telling automakers they need more mainstream cars to sell, but correcting the problem will take time.

How to Buy a Car Right Now

New car prices remain nearly $12,000 higher than five years ago, amid the COVID-19 pandemic. That’s when the average transaction price for new vehicles was around $38,563. However, with all the technological advances and offerings, your next car will likely last longer and help you drive safer than ever.

RELATED: Buying Older, Used Cars in 2026

Vehicle quality studies repeatedly show that today’s new cars suffer fewer problems than those from just a few years earlier. Buyers of higher-priced used cars will likely see the vehicle driving on the road even longer. The same goes for those buying new ones.

With most automakers now building such durable cars, they compete by adding more high-tech features. Features like adaptive cruise control and Apple CarPlay are now more common than ever on entry-level vehicles. Read on to see our tips on buying a car below.

How to Leverage Incentives to Buy a New Car

Last month, car incentives comprised about 7.5% of the average deal. To learn how to take advantage of incentives, read about our monthly best car deals to find dealer or manufacturer offers, including cash back and lower interest rates for financing your next vehicle.

RELATED: How to Buy a New Car in 10 Steps

Selling a Car Right Now

Few of us can sell a car without needing to buy a replacement. If you can sell now, what are you waiting for? You could get more for your vehicle if it’s in high demand, and that’s excellent news. The best way to get the most money for your used car is to sell it privately. But if you don’t want the hassle, there is still an opportunity to sell to a dealership.

PRO TIP: If selling a car, consider selling it peer-to-peer using Kelley Blue Book’s Private Seller Exchange marketplace. It’s a low-cost method that helps consumers earn more for their vehicles than selling to a dealership.

Trading in a Car Now

The ongoing shortage of used cars will be with us for years. As a result, you’ll likely still see respectable offers for your used car this month.

Searching for a decent price for your trade-in is still a good idea by shopping around. Each dealership tries to keep a balance of vehicles on its lot. Sometimes, the one you want to buy from doesn’t need your trade-in desperately, but a competitor does.

Research your vehicle’s Kelley Blue Book value, then call several local dealerships to see what they’ll offer you for it. Or try our Instant Cash Offer tool, which brings the deal to you from various dealerships without obligation. You can choose your preferred offer or use it to negotiate with others.

Is Trading in Your Vehicle a Good Idea?

Possibly. You could get more money than usual if your vehicle is in high demand. It will help defray the costs of buying a new or used car. However, if your vehicle is not in high demand, you can expect to get close to the Kelley Blue Book value. Use Kelley Blue Book’s car valuation tool to find out the price of your new or used car.

Can You Trade in a Vehicle That’s Not Paid Off?

Yes. Whether you have paid off your car or not, you can still trade it in. However, a car depreciates when you drive it out of the dealership. It’s best to take stock of how much equity you carry in the vehicle. Take the difference between the car’s current market value and what you owe to figure that out. Read our story on selling a car.

Looking Ahead

New car prices crossed the $50,000 line, and could stay above it indefinitely. Automakers will eventually have to address the yawning gap at the low-cost end of the car market. But they’re being conservative with their business decisions now, with few willing to take the risk of designing cheaper cars when the expensive ones are selling so well.

Used car prices, barring any unusual disruptions to the market, should increase only slightly.

If you need a new car soon, it might make sense to act now while prices remain steady.

RELATED: 10 Best Used Car Deals

Tips for Buying a Vehicle Right Now

If you shop right now, we recommend a few strategies to help you find the right new or used car that fits your budget.

- Expand your search. Widen your search to a broader geographic area because you could find a better deal or the used car you want outside your immediate area.

- Stay patient. Call dealerships to see what’s in stock for those high-demand vehicles. Leave a refundable deposit if you want first dibs.

- Buy a less expensive model. With higher car loan interest rates, consider buying a cheaper vehicle model instead of a more expensive one in the lineup you’re considering. Understand how much you can afford.

- Look for deals. Make sure to research car deals to find what works best for you. It may involve contacting or visiting several dealerships as you search for the right fit.

- Weigh your options. Don’t just look for a car; search for the best interest rates from banks or credit unions. Also, shop for your insurance rates ahead of the deal to know how much the higher auto insurance costs will be for your desired vehicle. Then, weigh all your options, including financing incentives and deals at the dealership, if that’s where you buy your next vehicle. Also, you may find that the prices of some newer-model used vehicles are almost the same as new cars. Just keep all your options open during your search.

- Avoid dealer markups. If you see a markup (sometimes called a “market adjustment”) on your final invoice, ask the dealer to remove it. If they refuse, shop at another dealership. Markups were more prevalent during the COVID-19 pandemic. However, dealers still mark up some vehicles that are in short supply.

- Question all add-ons. If your sales summary includes entries like “window tint,” “fabric protection,” “carpeted floor mats,” and other add-ons you didn’t request, ask the dealer to remove those line items from your invoice. Many dealers tack on these extras to make quick profits.

It may make more sense to keep your existing car for another year or two. If you must buy, be prepared to take excellent care of your next car to keep it running for a long time.

Editor’s Note: We have updated this article since its initial publication.